Wait! Before You Go…

Let Aviox Technologies give your idea the edge it deserves — with a free:

- 🚀 Smart Project Blueprint

- 💰 Accurate Cost & Resource Estimate

- 📅 Launch Timeline Strategy

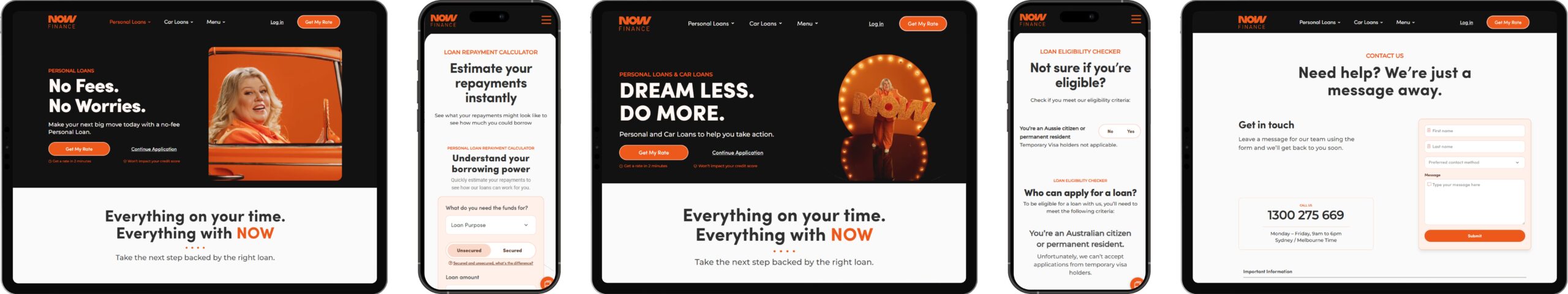

NOW Finance is an Australian non-bank lender offering hassle-free personal loans with a unique “no-fee” proposition.

Project Overview

Project OverviewNOW Finance is an Australian non-bank lender offering hassle-free personal loans with a unique “no-fee” proposition. The platform streamlines lending processes, allowing customers to get instant loan approvals after passing simple eligibility criteria. Users access everything online, from loan quotes to repayment calculators, supported by responsive educational resources and instant credit verification.nowfinance+2

Objective & Project Scope

Objective & Project ScopeThe primary objective was to create a fast, transparent, and conversion-driven digital experience that reflects NOW Finance’s no-fee, customer-first approach. The platform needed to reduce friction in the loan application journey while ensuring speed, security, and compliance.

User-friendly and trust-focused interface designed to simplify loan discovery and improve engagement across all devices.

High-performance website development with scalable architecture to handle growing traffic and user activity.

Loan calculators, eligibility tools, and CMS integration for smooth user journeys and easy content updates.

Fast load times, responsive layouts, and optimized workflows to support instant loan decisions.

Roles & Responsibilities

Roles & Responsibilities

Key Features

Key FeaturesInteractive calculators that help users instantly estimate repayments, loan amounts, and eligibility, improving decision confidence.

A streamlined, step-by-step loan application process designed to reduce drop-offs and ensure faster submissions.

Fully responsive design ensuring smooth performance across all devices, especially mobile users.

Flexible content management system allowing the NOW Finance team to update offers, pages, and compliance content effortlessly.

Optimized load times, secure data handling, and scalable infrastructure to support high traffic and rapid growth.

Project Challenges

Project ChallengesThis project demanded streamlined processing, secure integrations, consistent branding, and coordinated teamwork to deliver a reliable, scalable, and user-friendly solution.

Delivered instant eligibility checks and loan quotes while maintaining user privacy and meeting strict compliance standards.

Ensured a fast, seamless loan application process with instant verification and robust security measures.

Merged multiple backend systems—calculations, user management, and analytics—into one cohesive frontend experience.

Maintained uniform visuals and branding across WordPress, React, and marketing platforms.

Facilitated efficient collaboration between research, design, and development teams to meet tight project timelines.

A visual breakdown of the design, development, and performance that shaped the final product.

Project Approaches

Project ApproachesNOW Finance deployed a fully responsive and scalable bank management portal, allowing instant personal loan processing and online customer support.nowfinance

Users can get personalized quotes, check eligibility, apply for loans, and manage repayments—all from their phone or computer, with no bank fees or hidden charges.nowfinance

Conversion rates and customer satisfaction improved thanks to a frictionless UX and clear communication.

Platform scalability and performance enabled NOW Finance to grow its broker and direct-to-consumer lending channels without increasing operational overhead.mi

Seamless integration between Laravel, React, and CMS empowered content updates, analytics, and rapid feature iteration.

This approach focused on keeping things simple, reliable, and ready to grow with NOW Finance needs.

The NOW Finance bank management system is a strong example of designing fintech platforms for both speed and security. By combining modern frontend frameworks (React.js, Inertia.js), robust backend APIs (Laravel, MySQL), and content management (WordPress), the project delivered instant loan approvals, transparent user journeys, and business expansion across Australia. The site’s unique “no-fee” approach, paired with clear eligibility and calculator tools, empowered over 32,000 customers to access funds quickly, making NOW Finance an award-winning lender in its sector. My frontend leadership played a key role in transforming legacy loan workflows into a smooth, digital-first solution

Delivered a complete digital loan lifecycle — from eligibility checks and applications to approvals and disbursements — ensuring speed and clarity for users.

Enabled real-time loan decisions through optimized workflows and secure backend APIs, reducing manual effort and approval delays.

Designed intuitive journeys with clear calculators and no-fee transparency, improving trust, engagement, and customer satisfaction.

Built a robust and flexible system ready to support growing customer demand, new financial products, and future integrations.

Modernized legacy loan processes into a fast, digital-first platform through strong frontend architecture and performance-focused design.

Get In touch

Our Testimonials: